Current Rates

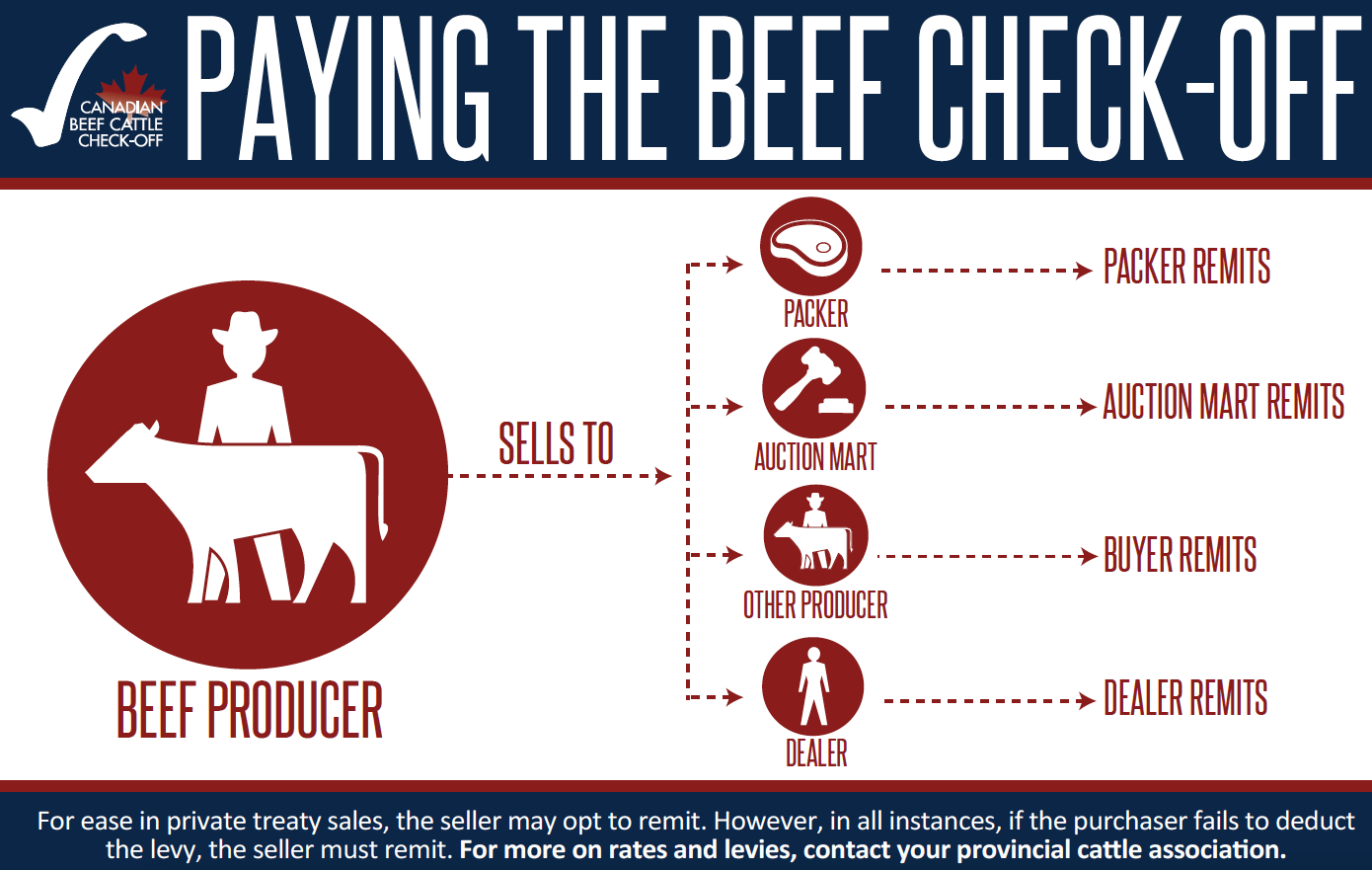

If you own cattle, you pay a mandatory levy each time you sell an animal. This levy is a combination of national and provincial check-offs. The collection and remittance of the levies in Canada vary by province and are an integral part of a sustainable and profitable industry.

The term “Canadian Beef Cattle Check-Off”, often called the national check-off, is used to describe the portion of the money that is invested in national beef cattle research, market development and promotion.

The provincial check-off is the portion used by the provincial cattle associations to carry out their mandate, which includes provincial advocacy, policy and trade initiatives.

These funds are collected in two ways:

- Provincial Levy: on cattle traded intra-provincially (within the same province)

- Federal Levy: on cattle traded inter-provincially (between provinces)

When cattle are sold in Canada, either the provincial levy or the federal levy is collected, not both, depending if the cattle are sold within the province, or across provincial borders.

Provincial Levy Rates (Rates are current as of January 1, 2026)

| Canadian Beef Cattle Check-Off | Provincial Check-Off | Total Levy Deducted | |

|---|---|---|---|

| BC | 2.50 | 2.50 | 5.00 |

| AB | 2.50 | 2.00 | 4.50 |

| SK | 2.50 | 2.75 | 5.25 |

| MB | 2.50 | 3.00 | 5.50 |

| ON Beef | 2.50 | 4.50 | 7.00 |

| ON Veal | 2.50 | 5.00 | 7.50 |

| QC Cull Cows | 2.50 | 20.40 | 22.90 |

| QC Bob Calves | 2.50 | 6.40 | 8.90 |

| QC Fed Cattle | 2.50 | 11.20 | 13.70 |

| QC Started Veal | 2.50 | 18.20 | 20.70 |

| QC Fed Veal | 2.50 | 15.25 | 17.75 |

| NB | 2.50 | 3.50 | 6.00 |

| NS | 2.50 | 3.50 | 6.00 |

| PE | 2.50 | 3.50 | 6.00 |

As of August 1, 2025 the amount of the federal levy is the same as the provincial levy where the seller of the beef cattle resides.

When a producer sells beef cattle in their home province, that producer pays the provincial levy to their provincial cattle association. Of that provincial levy, a portion (the Canadian Beef Cattle Check-Off) is paid to the Agency. The balance of the provincial levy is retained by the provincial cattle association.

Those who have questions about the calculation or remittance of levies on cattle traded should contact their provincial cattle association.